Financial Survival Tips for New Students in the USA

Budgeting Bliss: Financial Survival Tips for New Students in the USA

College life – a whirlwind of new experiences, academic challenges, and newfound independence. But amidst the excitement lies a crucial element: managing your finances. Without a solid plan, student life can quickly become stressful, leaving you scrambling to make ends meet.

This guide equips you, the new student, with the tools to navigate the financial waters of college. We’ll delve into the importance of budgeting, explore ways to save on everyday expenses, and unlock resources to help you offset college costs. Consider this your roadmap to financial security and peace of mind during your academic journey.

Why Budgeting Matters?

Think of a budget as your financial compass. It helps you track your income (money coming in) and expenses (money going out). It empowers you to make informed spending decisions, prioritize needs, and avoid unnecessary debt. Budgeting ensures you have enough for essential expenses like rent, food, and textbooks without neglecting the occasional fun night out.

Here’s why budgeting is crucial for college students:

- Financial Independence: No more relying solely on parents or guardians. Budgeting puts you in control of your finances, fostering a sense of responsibility and resourcefulness.

- Reduced Stress: Knowing your spending limits and having a plan reduces financial anxiety, allowing you to focus on academics and campus life.

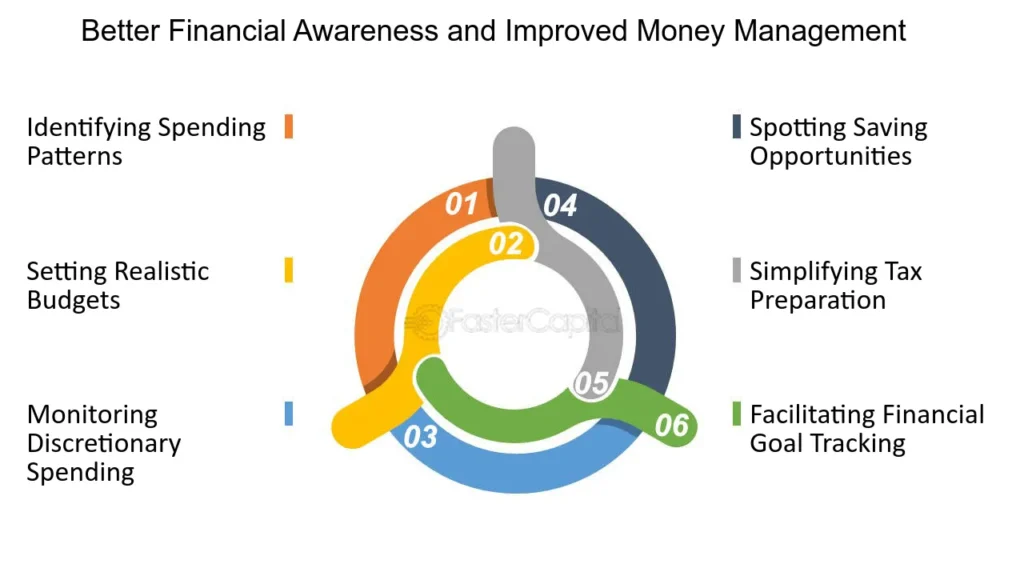

- Informed Decision-Making: Budgeting helps identify spending patterns and areas where you can save. Knowing where your money goes empowers you to make smart financial choices.

- Planning for the Future: Budgeting builds good financial habits that translate into financial security in the long run.

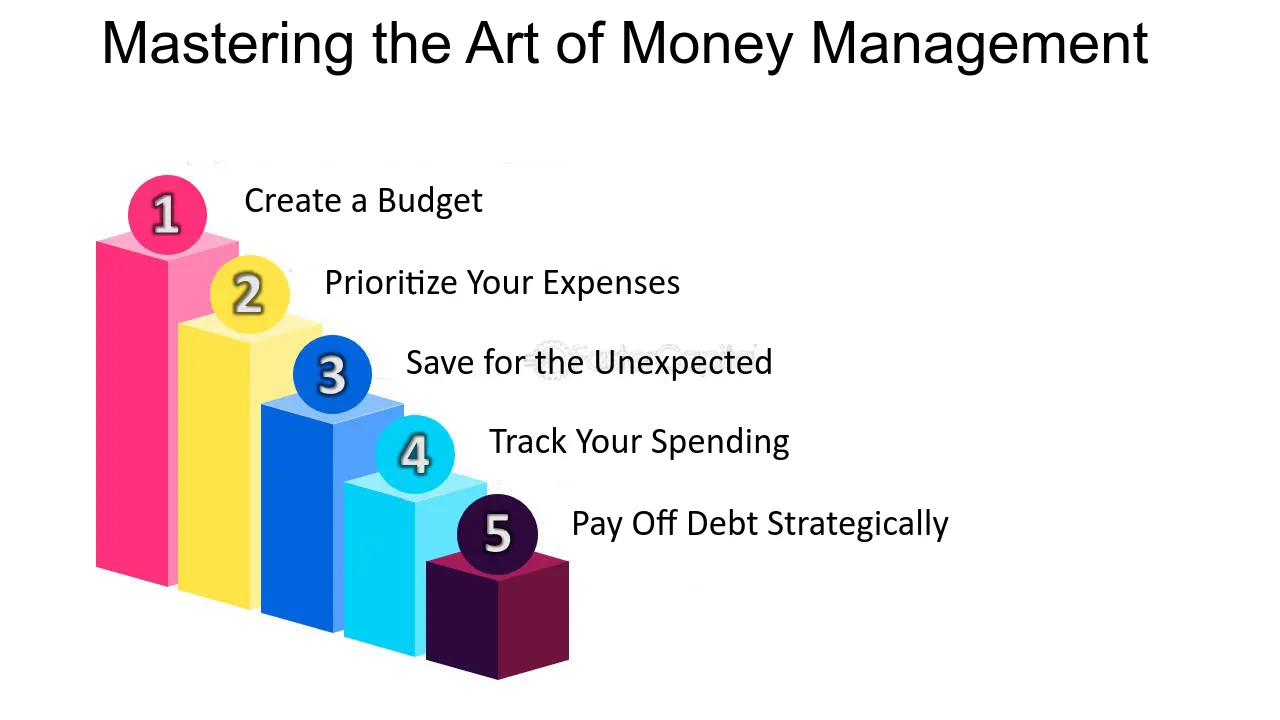

Building Your Budget: A Step-by-Step Guide

Ready to create your personalized budget? Here’s a breakdown of the steps involved:

Step 1: Track Your Income

List all your income sources. This could include:

- Financial aid: Grants, scholarships, and work-study programs awarded by the school or federal government.

- Part-time jobs: Salary or wages from any paid work you do.

- Allowance: If you receive regular financial support from parents or guardians.

Step 2: Identify Your Expenses

Categorize your expenses as follows:

- Fixed Expenses: Costs that remain relatively constant, such as:

- Rent: Monthly housing cost.

- Utilities: Electricity, water, internet (if not included in rent).

- Phone Bill: Monthly mobile phone plan fee.

- Loan Payments: If you have any student loans with fixed monthly payments.

- Variable Expenses: Costs that vary monthly, such as:

- Groceries: Food and beverages.

- Transportation: Bus passes, gas for a car, rideshare services.

- Textbooks & Supplies: Academic materials needed for classes.

- Entertainment: Movies, dining out, socializing.

- Personal Care: Clothing, toiletries, haircuts.

Step 3: Estimate Your Spending

Gather receipts or bank statements to estimate how much you typically spend on each category. Be realistic and factor in seasonal variations, like higher textbook costs at the start of a semester.

Step 4: Choose a Budgeting Tool

There are several budgeting methods and tools available:

- Pen & Paper: List income and expenses on paper or a spreadsheet.

- Budgeting Apps: Free or paid apps offering budgeting templates and tracking features.

- Online Budgeting Tools: Websites like Mint or Personal Capital provide expense tracking and personalized financial advice.

Step 5: Balance Your Budget

Compare your income to your expenses. Ideally, your income should exceed your expenses. If not, identify areas where you can cut back.

Step 6: Review and Adjust

Your budget is not static. Review it regularly, typically every month, and adjust spending categories as needed. Unexpected expenses can happen, so be prepared to adapt.

Saving Strategies: Stretching Your Dollar Further

College life doesn’t have to be synonymous with an empty wallet. Here are some tips to save money on essential and non-essential expenses:

Groceries:

- Plan Your Meals: Create a weekly meal plan to avoid impulse grocery purchases.

- Shop with a List: Stick to your list to avoid unnecessary items.

- Embrace Generic Brands: Generic products often offer the same quality as name brands at a lower cost.

- Stock Up on Staples: Buy in bulk for frequently used items during sales.

- Consider Cooking at Home: Pack lunches and eat out less.

- Explore Discount Grocers: Look for stores with lower prices and consider student discounts.

- Utilize Student Meal Plans: Many universities offer discounted meal plans that can be budget-friendly.

Transportation

- Utilize Public Transportation: Take advantage of student discounts on bus passes or explore public transportation options like subways or trams.

- Carpool or Rideshare Strategically: Split gas and parking costs with classmates who live nearby. Use rideshare services selectively, prioritizing times when public transport is unavailable or inefficient.

- Consider a Used Bike: Purchasing a used bike can be a cost-effective and healthy way to get around campus.

Textbooks & Supplies:

- Buy Used Textbooks: Check campus bookstores for used versions of textbooks or buy from online platforms like Chegg.

- Rent Textbooks: Many online services offer textbook rentals at a fraction of the purchase price.

- Share with Classmates: Form study groups and share textbooks or split the cost of purchasing one copy.

- Utilize Free Online Resources: Look for online resources like open educational resources (OERs) or online library databases that may offer free textbooks or relevant materials.

- Invest in Reusable Supplies: Opt for refillable water bottles and buy notebooks that you can use for multiple semesters.

Entertainment:

- Free Campus Activities: Explore free events on campus like concerts, movie nights, or club gatherings.

- Discounted Entertainment Options: Look for student discounts at movie theaters, museums, or sporting events.

- Embrace Free Entertainment: Explore nature walks, visit local parks, or have potlucks with friends.

- Embrace Public Entertainment: Many cities offer free or low-cost events like outdoor concerts or festivals.

- Borrow Instead of Buy: Borrow movies or games from friends instead of renting or purchasing them.

- Enjoy Free Streaming Services: Utilize free trials or student discounts on streaming services with a limited selection of shows and movies.

Additional Savings Tips:

- Open a Student Bank Account: Many banks offer student accounts with waived fees and perks like ATM rebates.

- Avoid Impulse Purchases: Resist the urge to buy things you don’t need. Give yourself a “cooling-off” period before making a purchase.

- Cook in Bulk: Cook larger meals and freeze portions for future lunches or dinners.

- Utilize Student Discounts: Many businesses offer discounts for students. Look for student ID promotions on clothes, restaurants, entertainment, and more.

- Sell Unused Items: Sell clothes, textbooks, or other items you no longer need online or at campus consignment shops.

Financial Aid Resources & Offsetting College Costs

College can be expensive, but there are several resources available to help you manage the financial burden:

- Federal Financial Aid: The U.S. Department of Education offers various grants, scholarships, and work-study programs. Complete the Free Application for Federal Student Aid (FAFSA) application to determine your eligibility.

- State and Institutional Aid: Many states and universities offer their own financial aid programs. Contact your school’s financial aid office to learn more.

- Scholarships: Research scholarships offered by organizations, companies, or foundations related to your field of study, location, ethnicity, or extracurricular involvement.

- Work-Study Programs: Federal work-study programs allow you to work part-time