Life Insurance in USA Must-Have Insurance for Every Life Stage

Navigating the Maze: Must-Have Insurance for Every Life Stage in the USA (2000+ Words)

The world of insurance can feel like a labyrinth – endless twists and turns, confusing jargon, and a constant nagging question: “Do I have the right coverage?” But fear not, fellow Americans! This guide will equip you with the knowledge to navigate this essential aspect of financial security. We’ll delve into the must-have insurance types at every critical life stage, from the exhilarating (yet often budget-conscious) years of young adulthood to the well-deserved stability of retirement.

By understanding the importance of different insurance products at different times in your life, you can make informed decisions to protect yourself, your loved ones, and your hard-earned assets. Buckle up, and let’s embark on this journey of insurance enlightenment!

Understanding Your Insurance Needs: A Life Stage Approach

Life throws curveballs, and being prepared for the unexpected is key. Insurance acts as a safety net, mitigating financial losses in case of unforeseen circumstances. However, your insurance needs evolve as your life progresses. Let’s explore the essential insurance types recommended for various life stages:

Young Adults (18-30):

This is a period of exploration, independence, and often, limited financial resources. Here’s what young adults should prioritize:

- Health Insurance: This is paramount. The Affordable Care Act (ACA) allows you to stay on your parent’s plan until age 26. But explore your employer-sponsored plans or individual plans if that’s not an option. Consider factors like copays, deductibles, and out-of-network coverage.

- Auto Insurance: It’s mandatory in most states. Explore minimum liability coverage to meet legal requirements. However, consider additional coverage like collision and comprehensive, especially if you own a financed vehicle.

- Renters Insurance: Often overlooked, renters insurance protects your belongings from theft, fire, and other covered perils. It’s relatively inexpensive and provides peace of mind.

Choose Your Own Adventure: Young Adult Scenario

Let’s personalize this with a scenario. Imagine you’re a 22-year-old recent college graduate with a new job. You share a rented apartment with two friends and just bought a used car with a loan.

- Health Insurance: You’re no longer eligible for your parents’ plan. Your employer offers a health insurance plan, but the monthly premium seems high. Action: Explore the specific details of your employer’s plan. Consider factors like copays, deductibles, and the plan network. You can also check the ACA marketplace (https://www.healthcare.gov/) to see if you qualify for subsidies that can lower your monthly premium.

- Auto Insurance: You want to save money but also want some protection for your car. Action: Get quotes from multiple insurance companies. Consider raising your deductible (the amount you pay out-of-pocket before insurance kicks in) to lower your premium. However, ensure the deductible amount is manageable in case of an accident.

- Renters Insurance: Your roommates have their own stuff, but you have some valuable electronics and furniture. Action: Renters insurance is typically quite affordable. Get quotes and choose a plan that covers the value of your belongings.

Building a Life: Families with Young Children (30-45):

This stage necessitates a more comprehensive insurance strategy to safeguard your growing family:

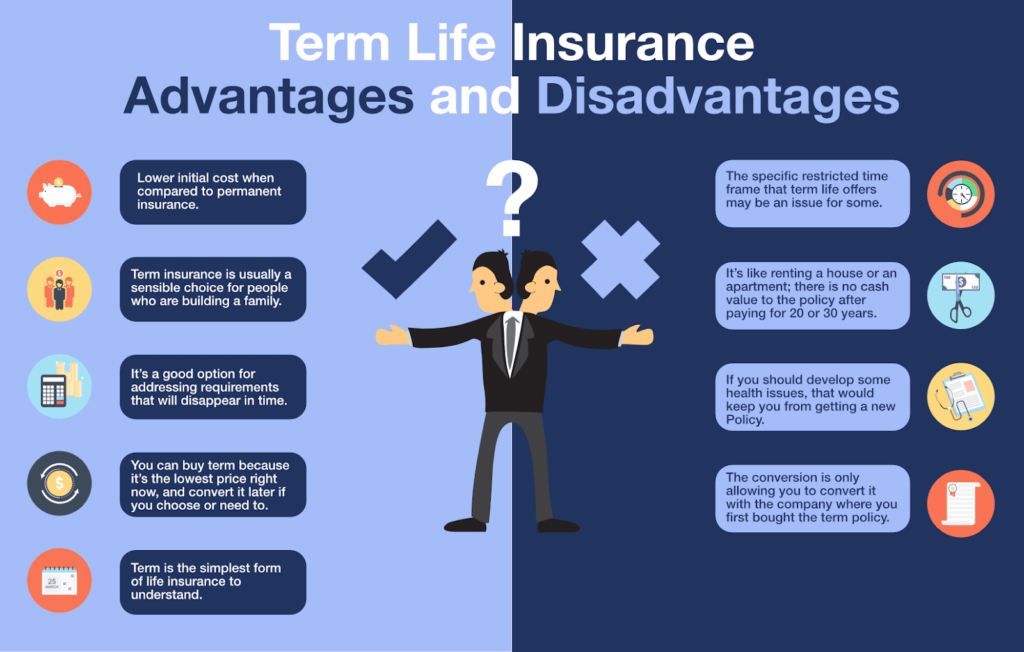

- Life Insurance: While young adults might not prioritize it, life insurance becomes crucial once you have dependents. Consider term life insurance – it offers affordable coverage for a specific period (e.g., 20 years).

- Health Insurance: Maintain your existing health insurance, or consider a family plan offered by your employer.

- Auto Insurance: Reassess your auto insurance needs. If you have a family car, you might need additional coverage for passengers and potential medical expenses arising from accidents.

- Disability Insurance: This protects your income if you are unable to work due to illness or injury.

- Homeowners Insurance: If you buy a house, homeowners insurance is mandatory. It covers your dwelling, belongings, and liability in case of an accident on your property.

Choose Your Own Adventure: Family Scenario

Imagine you’re a 35-year-old married couple with a 2-year-old child. You recently purchased a house and both have good health insurance through your employers.

- Life Insurance: While you have a decent emergency fund, you’re unsure if you need life insurance yet. Action: Consider how much your family would need financially if you were no longer around. Life insurance calculators can help you determine the appropriate coverage.

- Life Insurance (Continued): Think about your current debts (mortgage, car loans), future needs (college education for your child), and your spouse’s income. Term life insurance can provide a financial safety net for your family during this crucial period.

Choose Your Own Adventure: Family Scenario (Continued)

- Life Insurance (Continued): You decide to research term life insurance online. Calculators indicate a $250,000 policy would be sufficient. You compare quotes from several reputable insurance providers and find an affordable plan that fits your budget.

Expanding Your Horizons: Empty Nesters (45-65):

As your children leave the nest, your insurance needs shift:

- Life Insurance: Reevaluate your life insurance needs. You might consider reducing coverage as your financial obligations lessen.

- Long-Term Care Insurance: This can be a wise investment to cover potential nursing home or assisted living expenses in the future.

- Health Insurance: Continue with your employer-sponsored plan or explore Medicare options as you approach retirement age.

Choose Your Own Adventure: Empty Nester Scenario

Imagine you’re a 58-year-old couple nearing retirement. Your children are financially independent, and you’ve paid off your mortgage. You’re healthy but concerned about potential future medical needs.

- Life Insurance: You currently have a $500,000 term life insurance policy, but the premiums seem high.Action: Since your children are independent, you re-evaluate your life insurance needs. You decide to decrease your coverage to a more manageable $250,000 policy.

- Long-Term Care Insurance: You’ve heard horror stories about nursing home costs, but long-term care insurance premiums seem expensive.Action: Research long-term care insurance options. Consider factors like your age, health, and desired level of coverage. You can also explore hybrid policies that combine life insurance benefits with long-term care coverage.

Golden Years: Retirement (65+):

Retirement brings a well-deserved focus on security and enjoying your golden years:

- Medicare: This government-sponsored health insurance program is crucial for retirees. Explore Medicare Part A (hospital insurance) and Part B (outpatient medical insurance). Supplemental plans (Medigap) can help cover additional costs not covered by basic Medicare.

- Social Security: This provides a monthly income for retirees who have contributed throughout their working years.

Choose Your Own Adventure: Retirement Scenario

Imagine you’re a retired couple living comfortably on your Social Security benefits and a decent pension. You’re both healthy but want to ensure you have adequate medical coverage in case of future health issues.

- Medicare: You’re enrolled in Medicare Part A and Part B, but you’re worried about out-of-pocket expenses.Action: Research Medigap plans. These supplemental plans can help cover deductibles, copays, and other costs not covered by basic Medicare. Choose a plan that fits your budget and healthcare needs.

Remember: These are general guidelines. It’s crucial to consult with a qualified insurance professional to assess your individual needs and create a personalized insurance plan.

Additional Tips for Navigating Insurance:

- Shop around: Get quotes from multiple insurance companies before making a decision.

- Read the fine print: Understand exclusions and limitations of your policy.

- Review your coverage regularly: Your insurance needs evolve as your life progresses. Revisit your plan annually or whenever there’s a significant life change (marriage, childbirth, job change).

- Ask questions: Don’t hesitate to ask your insurance agent or broker for clarification on anything you don’t understand.

By following these tips and utilizing the “choose your own adventure” approach for different life stages, you can make informed insurance decisions and navigate the maze with confidence. Remember, insurance is an investment in your financial security.