Navigating Credit Card Debt in a Consumer

Conquering Credit Card Debt: Strategies for USA Spenders

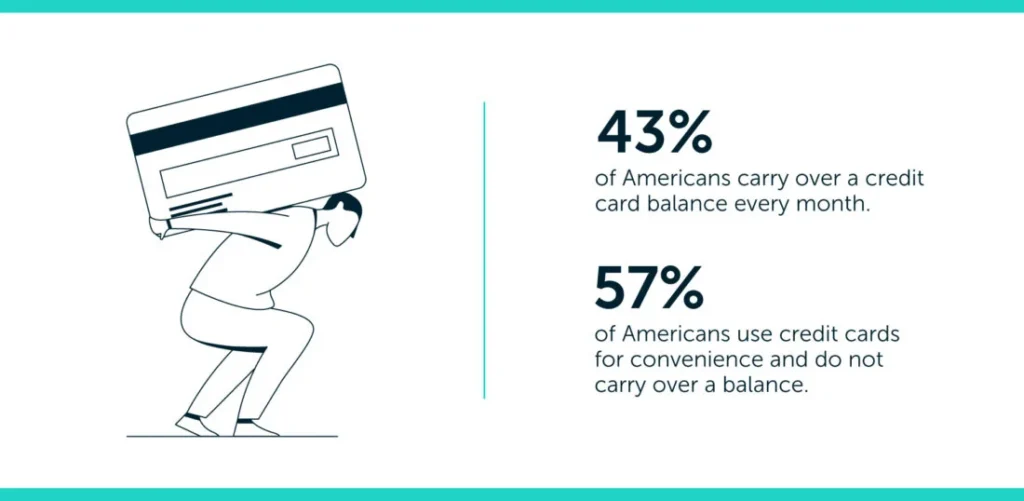

Credit cards offer a convenient way to make purchases, build credit, and even earn rewards. However, for many Americans, the ease of swiping plastic can lead to a mountain of credit card debt. If you’re one of the millions struggling with high balances and mounting interest, you’re not alone. But don’t despair! This blog post will equip you with the knowledge and strategies to conquer credit card debt and achieve financial freedom.

Understanding Your Debt: The First Step to Freedom

Before diving into specific tactics, it’s crucial to understand your current financial situation. Gather your credit card statements and list all your credit cards, including:

- Issuer (e.g., Chase, Bank of America)

- Current balance

- Interest rate (APR)

- Minimum payment

This comprehensive view will help you assess the severity of your debt and prioritize your repayment efforts.

Debt Payoff Strategies: Snowball vs. Avalanche

There are two main approaches to tackle credit card debt: the snowball method and the avalanche method. Both have their advantages, and the best choice depends on your financial personality and goals.

- The Snowball Method: This approach focuses on paying off the card with the smallest balance first, regardless of interest rate. Each successful payoff, no matter how small, gives you a psychological boost and keeps you motivated. The snowball method can be particularly helpful if you’re feeling overwhelmed by debt, as the quick wins can fuel your determination.

- The Avalanche Method: This strategy prioritizes paying off the card with the highest interest rate first. By focusing on high-interest debt, you save money in the long run. However, this method can take longer to see significant progress on account balances, which may discourage some people.

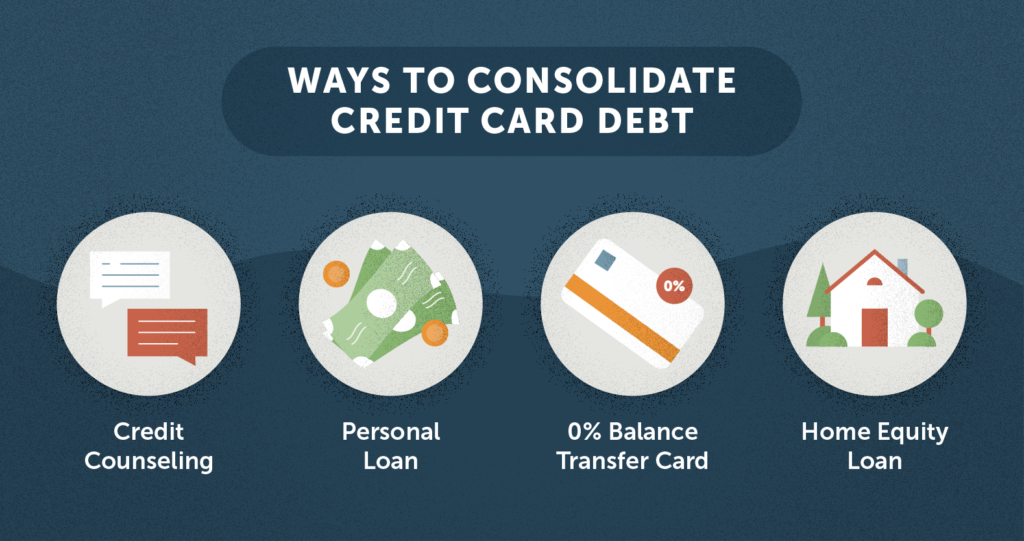

Choosing Your Weapon: Balance Transfer Cards

Balance transfer cards can be a powerful tool in your debt-conquering arsenal. These cards offer a 0% introductory APR period, typically lasting 12-18 months, on transferred balances. This allows you to focus on paying down the principal amount without interest accumulating, accelerating your debt repayment.

Here are some key things to consider when using balance transfer cards:

- Balance transfer fees: Most cards charge a balance transfer fee (typically 3-5% of the transferred amount). Ensure the savings on interest outweigh this fee.

- Eligibility: You’ll need good credit to qualify for the best balance transfer offers.

- Promotional period: Make sure you can pay off the transferred balance before the introductory APR expires. Otherwise, you’ll start accruing interest at a potentially high rate.

Seeking Help: Credit Counseling Services

If you’re struggling to manage your debt on your own, credit counseling services can offer valuable assistance. These non-profit or for-profit organizations provide:

- Debt management plans: Credit counselors can negotiate with your creditors to lower interest rates and consolidate your debt into a single monthly payment, making it easier to manage.

- Budgeting and financial education: Counselors can help you create a realistic budget and develop strategies to stick to it, preventing future debt accumulation.

Building a Budget and Sticking to It: Your Key to Financial Freedom

Creating a budget is the cornerstone of financial management and essential for conquering credit card debt. Here’s a step-by-step approach to building your budget:

- Track Your Income: Record all your income sources, such as your salary, side hustles, and any recurring benefits.

- Identify Expenses: Track all your expenses for a month, categorizing them as essential (housing, utilities, groceries) or non-essential (entertainment, dining out).

- Calculate Your Budget Deficit: Subtract your total expenses from your income. If your expenses are higher, you need to cut back.

- Prioritize Spending: Essential expenses come first. Allocate remaining funds towards debt repayment, savings goals, and non-essential spending.

- Track and Adjust: Regularly monitor your budget and adjust as needed. Unexpected expenses happen, so be flexible.

Sticking to Your Budget: Practical Tips

Once you have a budget, here are some tips to ensure you stick to it:

- Embrace Automation: Set up automatic payments for essential expenses and debt repayment. This removes the temptation to overspend and ensures you never miss a payment.

- Embrace the Cash Envelope System: Withdraw cash for non-essential spending categories and stick to the allocated amount. Seeing the physical cash disappearing can be a powerful deterrent against overspending.

- Track Your Progress: Regularly track your spending and debt payoff progress. Seeing the positive changes can be a major motivator.

- Review Regularly: Review your budget at least monthly. Adjust it based on changes in income or expenses.

- Embrace Frugal Living: Explore ways to reduce your non-essential spending. Consider cooking at home more often, finding free or low-cost entertainment options, and rethinking subscriptions you rarely use.

- Boost Your Income: Look for ways to increase your income, even temporarily. This could involve taking on a side hustle, monetizing a hobby, or negotiating a raise at work. Every extra dollar can be put towards debt repayment.

- Sell Unused Items: Declutter your living space and turn unused items into cash. Online marketplaces or consignment shops can be great avenues for selling gently used clothes, electronics, or furniture.

- Avoid Impulse Purchases: Resist the temptation of impulse buys. Implement a “waiting period” before purchasing non-essential items. This allows you to re-evaluate the need and avoid buyer’s remorse.

Staying Motivated on the Debt-Free Journey

Paying down debt can feel like a marathon, not a sprint. Here are some ways to stay motivated:

- Visualize Your Goals: Set clear financial goals for yourself, both short-term (paying off a specific card) and long-term (financial freedom). Visualize what achieving these goals will mean for your life.

- Celebrate Milestones: Acknowledge your progress, no matter how small. Celebrate each paid-off credit card or significant reduction in your overall debt.

- Find a Support System: Share your debt-free journey with a trusted friend, family member, or online support group. Having someone to hold you accountable and celebrate your wins can be incredibly motivating.

- Reward Yourself: Set realistic rewards for yourself after achieving debt milestones. This could be a weekend getaway, a nice dinner out, or anything that motivates you to keep pushing forward.

Additional Resources for Your Debt-Free Journey

- National Foundation for Credit Counseling (NFCC): https://www.nfcc.org/ offers free resources and can connect you with a certified credit counselor in your area.

- Consumer Financial Protection Bureau (CFPB): https://www.consumerfinance.gov/ provides educational resources on credit cards, debt management, and building a budget.

- Debt Snowball vs. Debt Avalanche Calculator: https://www.nerdwallet.com/article/finance/what-is-a-debt-snowball This tool can help you determine which debt repayment strategy best suits your financial situation.

Remember: Conquering credit card debt is a journey, not a destination. There will be setbacks along the way. The key is to stay focused, celebrate your progress, and adapt your strategies as needed. By following the advice presented in this blog post and utilizing the available resources, you can achieve financial freedom and a brighter financial future.